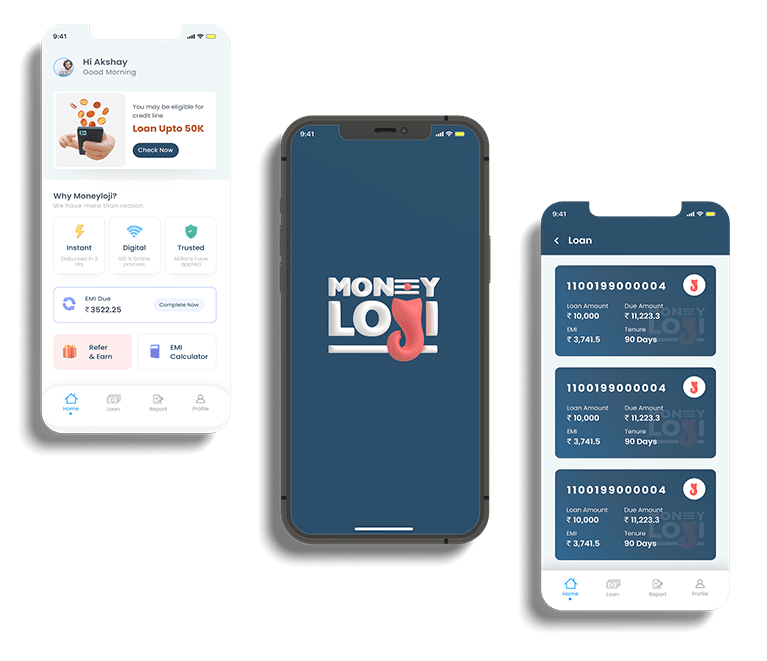

Instant Fuss Free Loans for our Lady Customers

Simply Download Our App and Check your Loan Eligibility

MoneyLoji has a special place for Working Women. With a smooth loan screening process and smart technology, easy loan application and incentives in terms of interest rates and repayment options, MoneyLoji ensures that women borrowers are given a platform to grow.

Fast Approvals

Get instant approvals within minutes and do away with all your financial worries.

Minimal Documentation

With our seamless app, you don't have to worry about long and lengthy documentation processes.

Best Interest Rates

We pride ourselves on our interest rates which are lowest in the industry.

Trusted by 40,000+ Working Women

India’s best, most secure app

MoneyLoji has a special place for Working Women. With a smooth loan screening process and smart technology, easy loan application and incentives in terms of interest rates and repayment options, MoneyLoji ensures that women borrowers are given a platform to grow.

Eligibility Criteria

- Loan Amount : ₹10,000 to ₹50,000

- Loan Tenure : 3 Months to 6 Months

- Interest Rate : 1.5-4% per Month

- Minimum Credit Score : Crif Score-600+

- Repayment Frequency : Monthly

- Min Income Criteria : ₹20,000 PM

- Age Criteria : Min 21 Years to Max 50 Years

- Pan-India Servicing of Loans

- Processing Fee : ₹499+GST for Loans upto ₹30,000 or ₹799+GST above ₹30,000

- No male member document required

5+ lakh people trust MoneyLoji

Fill Form to Check Eligibility

Frequently Asked Questions

Moneyloji (owned by Creditech Technology Pvt Ltd) is a digital lending platform for the next billion users in India. One can apply for a Salary Advance loan of up to Rs.50000. At Moneyloji, we have developed a differentiated, and personalized user experience that enables borrowers to compare rates for loans from RBI registered NBFCs and banks, and apply instantly. Our USP is the ability to disburse loans in under 5 minutes.

We believe getting a loan today should be as easy and simple as online shopping, and not tiring or embarrassing. Think of us as your trusted friend you can borrow from without hesitation. We are committed to serving you in a trusted manner and we care deeply about user privacy & data security.

To avail our services, you must download our App. We’re currently available only on Android as of now. iOS app is under development and you should be able to download the same in the next 3 months.

The basic eligibility criteria that you will need to meet for your loan application to be approved is to be checked on the banks’ respective websites. Alternatively, you can also use the personal loan eligibility calculator tool, which you will find on the websites of banks and financial institutions and on third-party financial services websites like BankBazaar.com.

The maximum sum of money that you will be able to borrow from Moneyloji will vary based on a number of factors. If you are a salaried employee, your monthly EMI should ideally not exceed 40% of your monthly pay. Also, the bank/NBFC will take into account if you have any existing loans for which you pay EMIs. The concerned individual’s other financial liabilities will also be taken into account. The maximum loan amount offered will also depend on the Moneyloji’s own terms and conditions.

Moneyloji allows borrowers to choose a loan tenure between 3 month and 6 month, based on their convenience.

The following documents are required when applying for a Personal Loan-

- Proof of identity (Pan Card)

- Address proof (Aadhaar Card, Driving License, Voter Card, Passport)

- Proof of income (Latest 3 Month Salary Slip)

- Latest 3 Month Bank Statements

You can find it by clicking on the Loans sections and click on your existing Loan line. The repayment period start after 30 days from the loan agreement. You can find your loan schedule in the loan agreement. There will be no provision of change in the emi schedule after signing the loan agreement as you bind to agree the term & condition of the agreement.

A few things that you should consider when applying for a personal loan are as follows:

- Interest Rates: The interest rate charged for a personal loan can go from as low as 36% p.a. to as high as 72% p.a., based on the Moneyloji’s terms and conditions and your credit score. The interest rate makes a substantial difference to the cumulative cost of the loan.

- Repayment Flexibility: Make sure to check if the lender allows part-payments or prepayments and if there is any penalty levied for making the payment.

- Processing Fee: Even if you are offered a low interest rate, a high processing fee could bump up the cost of your loan.

- Customer Service: Moneyloji has sufficient customer care channels for you to reach us on. Moneyloji also answers your queries in a prompt manner.

Yes, your loan application can be considered, with earlier employment details and documentation. Minimum employment criteria for a loan is 6 Months.

Late Payment Charges: You will be charged a late payment charge of Rs 750 if you do not pay your EMI on the due date. Due Date will be varies from Month to Month basis.

Penal Charges: You will be charged 0.6% penal charges on the overdue amount if you miss your emi’s. These charges increases on day to day basis.

No. We only support loan repayments through the Moneyloji app via Debit Card, Net-Banking, UPI, Bank Transfer, Paytm Wallet or Paytm QR Code. If you are facing any issue while repaying your loan, kindly write to us an email on payment.assistance@moneyloji.com and we shall look into it asap.

While following the auto-pay schedule is recommended you are free to pay your EMIs anytime you want. To do so, select your drawdown from the “Pay Now” Tab. You have to maintain sufficient balance in your account for 24-48 hours to complete the Auto-pay schedule.